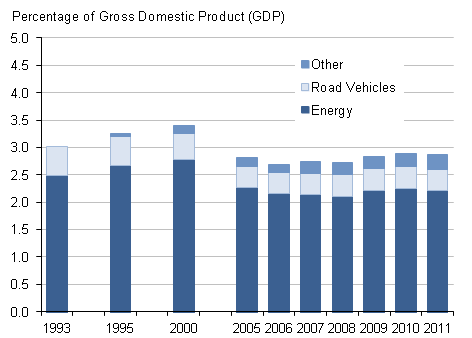

The Office of National Statistics (ONS) states quite confidently that in 2011, the UK Government received £43.3 billion from environmental taxes.

But yesterday, HM Treasury stated just as confidently that in 2011/12 the actual revenue raised from environmental taxes was £3.1 billion, a drop of more than 90% from the ONS figure.

What is going on? The answer is that the Treasury has unilaterally decided to re-define environmental taxes to exclude taxes such as Vehicle Excise Duty, Fuel Duty and Air Passenger Duty, which bring in the bulk of the revenues in the ONS figure. Fuel duty alone, mainly on petrol and diesel for road transport, brought in nearly £30 billion in 2011. Commentators have speculated that this re-definition will make it easier for the Government to claim that revenues from environmental taxes are rising over the next few years, which was a Coalition Agreement pledge, and have damned it as extraordinary and evidence of a fantasy world inhabited by Treasury trolls.

What hasn’t yet been noticed is that the Treasury re-definition makes it easier to argue the case for a sensible pricing of carbon dioxide emissions. The evidence suggests that the best starting price is about $100 per tonne of CO2, which implies adding about 12 pence to the price of a litre of petrol. In the past it has been possible to argue that the fuel duty on petrol was a green tax that easily exceeds this, so why should there be a CO2 price on top? The Treasury’s redefinition removes this argument at a stroke by explicitly stating that the aim of fuel duty is not environmental but revenue raising. It seems that every cloud has a silver lining.

Leave a Reply